Calculate tax taken out of paycheck

See where that hard-earned money goes - Federal Income Tax Social Security. For example if an employee earns 1500 per week the individuals.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Import Payroll Runs To Be Automatically Categorized As Expenses.

. Take these steps to determine how much tax is taken out of a paycheck. The employer portion is 15 percent and the. FICA taxes are commonly called the payroll tax.

Over 900000 Businesses Utilize Our Fast Easy Payroll. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after. 10 percent 12 percent 22 percent 24 percent 32.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Your average tax rate. That means that your net pay will be 43041 per year or 3587 per month.

See how your refund take-home pay or tax due are affected by withholding amount. Sign Up Today And Join The Team. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Next select the Filing Status drop down menu and choose which option applies. Free salary hourly and more paycheck calculators. The current tax rate for social security is 62 for the employer and 62 for the employee or.

What percentage of federal taxes is taken out of paycheck for 2020. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. What percentage of taxes are taken out of payroll.

Learn About Payroll Tax Systems. Free Online Paycheck Calculator for Calculating Net Take Home Pay. Free Unbiased Reviews Top Picks.

Ad Check Out Our Best Paycheck Software Reviewed By Industry Experts. First enter your Gross Salary amount where shown. The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out.

Review current tax brackets to calculate federal income tax. Ad Unlimited Payrolls Automatic Tax Filings And Payments Direct Deposit. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. However they dont include all taxes related to payroll. Use this tool to.

The federal income tax has seven tax rates for 2020. Using the United States Tax Calculator is fairly simple. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Discover The Answers You Need Here. What is the percentage that is taken out of a paycheck. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Try It For Free. Ad Compare This Years Top 5 Free Payroll Software. FICA taxes consist of Social Security and Medicare taxes.

It can also be used to help fill steps 3 and 4 of a W-4 form. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Current FICA tax rates.

Estimate your federal income tax withholding. Free Unbiased Reviews Top Picks. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Simplify Your Day-to-Day With The Best Payroll Services. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld.

Ad Compare This Years Top 5 Free Payroll Software. The state tax year is also 12 months but it differs from state to state. Some states follow the federal tax.

For starters all Pennsylvania employers will.

Hourly Paycheck Calculator Step By Step With Examples

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

California Paycheck Calculator Smartasset

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Payroll Tax Deductions Monster Ca

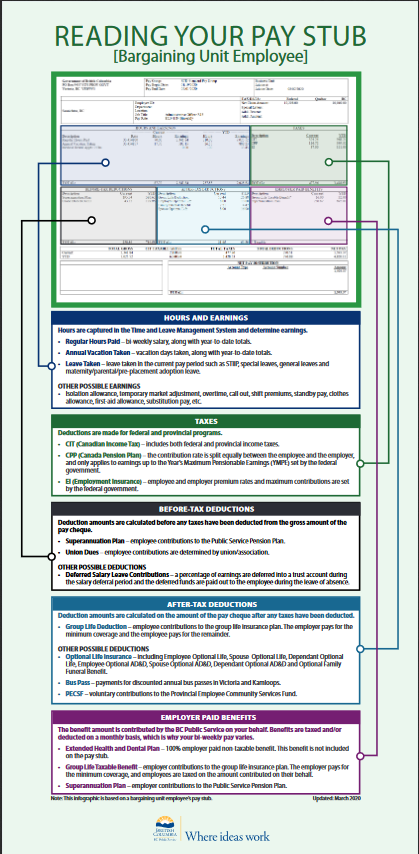

How To Read Your Pay Stub Province Of British Columbia

Calculating Federal Taxes And Take Home Pay Video Khan Academy

The Measure Of A Plan

Mathematics For Work And Everyday Life

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Understanding Your Paycheck

Different Types Of Payroll Deductions Gusto

Mathematics For Work And Everyday Life

How To Calculate Taxes Using A Paycheck Stub The Motley Fool

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time